The 10-Minute Market Research Method That Actually Works

Most product teams or founders spend weeks and thousands of dollars on market research. They hire consultants, run surveys, organize focus groups, and buy expensive industry reports. But there's a goldmine of customer insights sitting right in front of you. Real customers are already telling you exactly what they want, what frustrates them, and what gaps exist in the market.

The problem? Most research tools can't access the real insights hiding behind login walls, captchas, and anti-scraping measures.

Here's how to extract genuine market intelligence in just 10 minutes using tools you already have.

Why User Reviews Are a Goldmine of Ideas

User reviews tell you everything you need to know:

- What customers actually want (not what they say they want)

- Where competitors are failing

- Which features matter most

- What language your audience uses

- Hidden pain points nobody talks about

The best part? People write reviews when they're emotional. Happy, frustrated, excited, angry - that's when the real truth comes out.

The 10-Minute Method Breakdown

This isn't theory. It's a step-by-step system that works.

Step 1: Target Identification (2 minutes)

- Pick your market and identify 3-5 main players

- List the review platforms where customers actually talk

Step 2: Extract Customer Reviews (3 minutes)

- Access authenticated content (not just public scraping)

- Gather reviews from multiple platforms simultaneously

Step 3: AI Analysis (3 minutes)

- Use strategic prompts to identify pain points and gaps

- Focus on actionable insights, not surface-level sentiment

Step 4: Validate and Prioritize (2 minutes)

- Cross-reference insights across platforms

- Identify the most promising opportunities

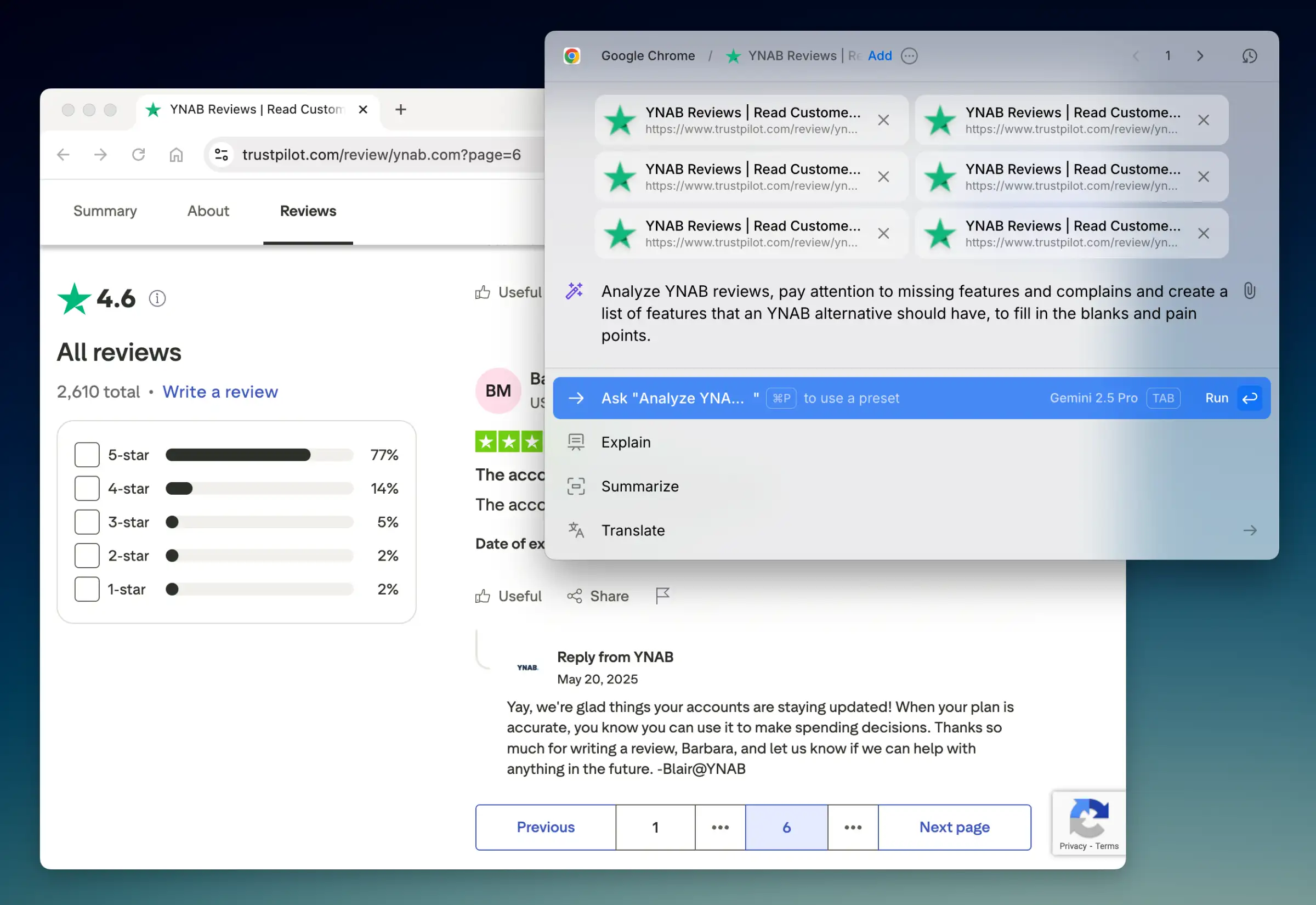

See real-life example analyzing YNAB app below.

Why Traditional Market Research Fails

The Web Scraping Problem

Most research tools hit the same walls:

- Captchas block automated access

- Login requirements hide real reviews

- Rate limits slow down data collection

- Anti-scraping measures block IP addresses

When you can only see 20% of the available data, your conclusions will be wrong.

The AI Research Gap

Tools like Perplexity and ChatGPT can't access authenticated content. They're limited to publicly available information that's often outdated or incomplete.

You end up with surface-level insights instead of the real customer voice.

The Human Research Bottleneck

Traditional methods are slow and expensive:

- Surveys take weeks to design and execute

- Focus groups cost $5,000+ for 10-12 opinions

- Industry reports are months old by publication

- Consultant reports reflect their biases, not customer reality

Solution: Browser-Based Review Extraction

Here's what changes everything: extracting reviews directly from your browser while you're logged in.

This bypasses all the traditional limitations:

- ✅ Access G2 reviews

- ✅ Extract Trustpilot data

- ✅ Analyze Amazon reviews

- ✅ Mine Reddit or X discussions (authenticated access)

- ✅ Review competitor feature requests on Canny.io, Featurebase

- ✅ Access private social media discussions

With Kerlig's browser content capture, you can extract content from any page you can see, including those behind login walls and paywalls.

Real Example: Finding a YNAB Alternative Opportunity

Let me walk you through a real analysis that took exactly 10 minutes.

Step 1: Target Identification (2 minutes)

Market: Personal finance apps

Main player: YNAB (You Need A Budget)

Review platforms:

- G2 (detailed business reviews)

- Trustpilot (consumer feedback)

- Reddit r/YNAB (unfiltered opinions)

- App Store reviews

Step 2: Review Extraction (3 minutes)

Using Kerlig, I captured content from:

- 320 Trustpilot reviews

- 50 G2 reviews (accessed while logged in)

- 10 App Store 1-star reviews

- 5 Reddit posts with complaints from the past 6 months

Step 3: AI Analysis with Strategic Prompt (3 minutes)

Here is the prompt I used to focus the AI model on missing features, complaints and opportunities:

Reviews analysis prompt

Analyze these YNAB reviews. Pay attention to missing features and complaints. Create a list of features that a YNAB alternative should have to fill in the gaps and pain points.

Analysis revealed 5 areas with major pain-points and how to address them:

1. Flexible and Fair Pricing Model

- Tiered Subscriptions: Offer multiple pricing tiers, including a basic or free version for simple tracking and a premium version with advanced features. This addresses the common complaint that the price is too high for users who don't need all functions.

- Regional Pricing: Implement purchasing power parity or regional pricing to offer a fair cost to international users, especially those in countries with weaker currencies.

- One-Time Purchase Option: Provide a "lifetime" license as an alternative to the subscription model for users who prefer to own their software.

2. Superior Bank & Data Integration

- Robust International Bank Sync: Prioritize reliable, wide-ranging bank connections across multiple countries, including Canada, Malaysia, and European nations. Ensure the connection provider is stable and requires minimal re-linking.

- Investment Account Tracking: Integrate seamlessly with investment and brokerage accounts (like E-Trade) to provide a complete financial picture.

- Advanced Transaction Automation: Automatically categorize split transactions from retailers like Amazon by pulling detailed order data, reducing manual entry.

- Receipt Scanning and Storage: Allow users to attach photos or scans of receipts directly to transactions for easy record-keeping.

3. Enhanced Budgeting and Planning Flexibility

- Advanced Forecasting Tools: Move beyond immediate budgeting to allow users to create financial forecasts and "what-if" scenarios for future income changes, large purchases, or life events.

- Flexible Budgeting Cycles: Support non-monthly budget targets, such as bi-weekly mortgage payments or weekly spending goals.

- Optional Zero-Based Budgeting: While offering a zero-based method, do not force it. Allow users who prefer a more traditional tracking or forecasting model to use the app without being confined to the "give every dollar a job" philosophy.

- Smarter Rollover Options: Provide more user control over how funds roll over from one month to the next, including options for both positive and negative category balances.

4. Intuitive User Experience and Customization

- Simplified Onboarding: Create an interactive, in-app tutorial that introduces features incrementally, reducing the steep learning curve associated with YNAB.

- Customizable Interface: Allow users to reorder account lists, hide features they don't use (like budgeting or overspending alerts), and customize the dashboard to their liking.

- Superior Reporting and Analytics: Offer a dedicated reporting section with interactive graphs and charts that allow users to easily visualize spending trends by category, payee, or time period without having to hunt for them.

- Full Internationalization: Provide full translation of the app and support materials in multiple languages, such as French and Spanish.

5. User-Centric Policies and Communication

- Transparent Data Retention Policy: Clearly communicate data retention policies for trial and inactive accounts, and provide multiple email warnings before any data is permanently deleted.

- Stable Feature Set: Avoid removing features that loyal users depend on. If a feature is to be deprecated, communicate the change well in advance and provide alternative solutions.

- Minimal and Relevant Communication: Ensure marketing emails are opt-in and provide clear value, avoiding the "spam" experience some users report.

Step 4: Validation and Prioritization (2 minutes)

Now comes the crucial part: turning insights into action.

Quick Validation Check:

I ran a follow-up prompt to validate the findings:

Validate findings prompt

Based on these YNAB reviews, rank the top 3 most mentioned pain points by frequency. Also identify which complaints appear across multiple review platforms (G2, Trustpilot, Reddit, App Store).

Cross-Platform Validation Results:

- Pricing concerns (mentioned on all 4 platforms) - Highest priority

- Steep learning curve (mentioned on 3/4 platforms) - High priority

- Mobile app limitations (mentioned on 3/4 platforms) - High priority

- Bank sync issues (mentioned on 2/4 platforms) - Medium priority

- Investment tracking (mentioned on 1/4 platforms) - Lower priority

Prioritization Matrix:

- Build first: Features that solve problems mentioned across multiple platforms

- Build second: High-frequency complaints from single platforms

- Build later: Nice-to-have features mentioned occasionally

This validation step prevents you from chasing one-off complaints and helps you focus on real market gaps.

Why This Method Works Better Than Alternatives

Compared to Traditional Surveys

Traditional surveys suffer from inherently biased responses and limited sample sizes. In contrast, this method leverages unsolicited, authentic feedback from real users, providing a more accurate picture of customer sentiment.

Compared to Web Scraping Tools

While web scraping tools frequently get blocked by captchas and return incomplete data, this method provides access to complete datasets including authenticated content, ensuring comprehensive coverage of customer feedback.

Compared to AI Research Assistants

AI research tools are typically limited to public data and often work with outdated information. This method enables real-time access to private discussions and reviews, keeping insights current and comprehensive.

Compared to Focus Groups

Focus groups only capture 10-12 opinions in an artificial environment that may not reflect real usage. This method analyzes thousands of real opinions from actual customers using the product in their day-to-day lives.

Advanced Tips for Better Results

Use Specific Analysis Prompts

Instead of "analyze these reviews," try:

- "What features do customers wish existed but don't?"

- "What causes customers to switch to competitors?"

- "What do 5-star reviews praise that 1-star reviews ignore?"

- "What temporal patterns exist in complaints over the past year?"

Compare Across Multiple Platforms

Different platforms reveal different insights:

- G2: Business user perspectives, detailed feature requests

- Trustpilot: Consumer sentiment, service quality issues

- Reddit: Unfiltered opinions, workaround discussions

- App stores: Mobile experience feedback

Look for Time-Based Patterns

Recent complaints often reveal:

- New bugs or feature changes

- Emerging competitor advantages

- Shifting customer expectations

- Market evolution trends

Extract Both Positive and Negative Feedback

Don't just focus on complaints:

- Positive reviews reveal what you must get right

- Negative reviews show opportunities for differentiation

- Neutral reviews often contain the most actionable insights

Common Mistakes to Avoid

1. Relying Only on Public Reviews

Public scraping misses 60-80% of available feedback. The most valuable insights are often behind login walls.

2. Analyzing Too Few Reviews

Don't draw conclusions from 10-20 reviews. You need at least 100+ data points for reliable patterns.

3. Ignoring Context Behind Complaints

A complaint about "slow performance" could mean:

- Technical performance issues

- Slow customer support response

- Slow feature development

- Slow learning curve

Context matters for actionable insights.

4. Not Validating Insights

One platform might have biased opinions. Always cross-reference insights across multiple sources before making decisions.

5. Focusing Only on Features

Customers complain about:

- Missing features (what to build)

- Poor implementation (how to build better)

- Bad experience (what to avoid)

- Pricing concerns (how to position)

Don't just build feature lists. Understand the complete customer experience.

Beyond the Basics – What Else You Can Research

Pricing Research

Uncover how customers really feel about pricing models, subscription costs, and value perception across different market segments.

Pricing sentiment analysis

What do users say about pricing?

Cost factor identification

When do people mention cost as a factor?

Feature Prioritization

Identify which features drive customer satisfaction and which missing capabilities create the biggest frustrations.

Top praised features

Which features get mentioned most in positive reviews?

Missing feature gaps

What missing features cause negative reviews?

Market Positioning

Discover how customers categorize your market and which competitors they naturally compare you against.

Category positioning analysis

How do users describe this product category?

Competitor comparison analysis

What alternatives do they compare it to?

Customer Segments

Reveal the actual demographics, company sizes, and use cases of your target market based on real user data.

Business type segmentation

What types of businesses use this product?

Team size analysis

What team sizes appear most often?

Your Next Steps

The competitive advantage goes to those who can access ALL customer feedback, not just the public scraps.

Start today:

- Pick your biggest competitor

- List 3-4 platforms where their customers leave reviews

- Use Kerlig to extract content from these platforms

- Run the analysis with strategic prompts

- Validate patterns across platforms

Your next breakthrough product is hiding in plain sight. The insights are there – you just need the right tools to extract them.

The Bottom Line

Ten minutes can reveal what months of traditional research miss.

While your competitors are spending weeks on surveys and focus groups, you can identify market gaps and customer pain points in the time it takes to drink a coffee.

The method is simple. The tools are available. Execution is what separates winners from researchers.

Your next successful product launch starts with understanding existing failures. The customer voice is already out there – now you know how to hear it.

Ready to find your next opportunity? Fire up your browser, pick a competitor, and start listening to what their customers are really saying.

The insights are waiting. The only question is: will you be the first to act on them?

Want to see this method in action? Try Kerlig's browser capture feature and discover what your competitors' customers are really saying.